- Published on

The Commercial Potential of Earth Observation in Africa

Preamble

This article is the final piece in a three-part series exploring the true potential of EO in Africa. Read Part 1 and Part 2 first.

Introduction

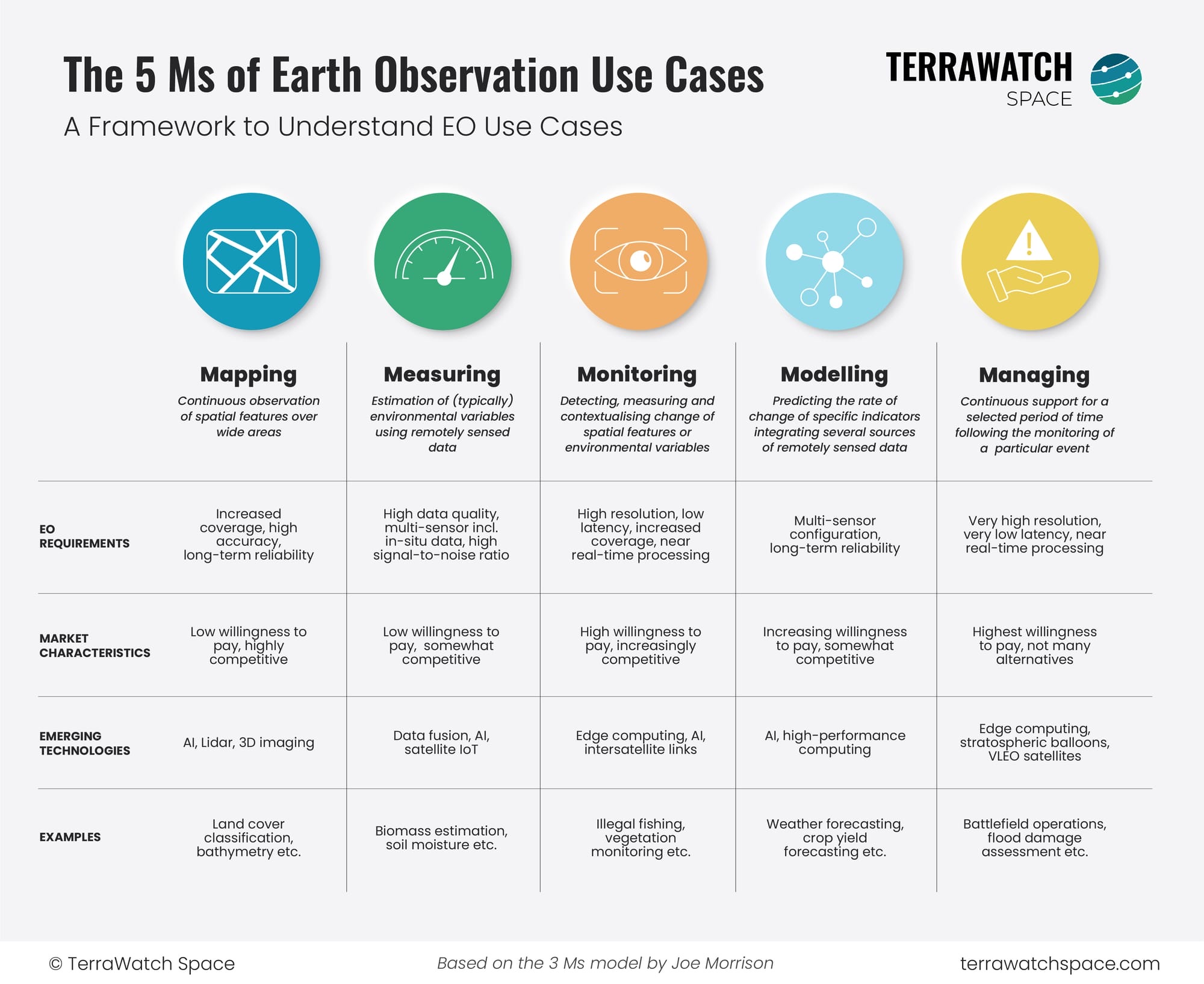

Earth Observation (EO) operates across a spectrum of use cases, each with different requirements, value potential, and commercial models. A useful way to understand this is the “5 Ms of EO”: Mapping, Measuring, Monitoring, Modeling, and Managing proposed by TerraWatch Space. I believe this framework is helpful for understanding the different ways EO creates value and for identifying which of those can already support commercial business models, and which still depend on policy and incentives to become viable.

Photo from TerraWatch Space Newsletter

We can already see this playing out across different sectors. In areas like agriculture, mining, finance, and disaster management, EO is increasingly aligned with existing demands, workflows, and funding mechanisms making commercial uptake more feasible. In others, such as logistics or renewable energy, the value is evident but the business case is still evolving. This suggests that the market structure for EO will likely develop in two ways:

- By delivering targeted solutions in sector-specific verticals (e.g. agriculture, mining, disaster management), and

- By strengthening horizontal service layers that cut across sectors and absorb EO as embedded intelligence.

In fact, some of the commercial examples shared in this article reflect EO-backed services that have already been deployed across Africa. These cases demonstrate that a functioning market exists, but we still have limited visibility into the true scale of that market and how often demand recurs. Understanding that gap is key to building local models that can scale sustainably.

In this article, we explore how EO can support specific market sectors in Africa and examine each sector through a practical lens: identifying the existing systems, the decisions currently being made, and crucially, who would be willing to pay for EO-powered insights and why. By doing so, we also categorize where each sector falls within the 5Ms framework to better understand where commercial value can be unlocked.

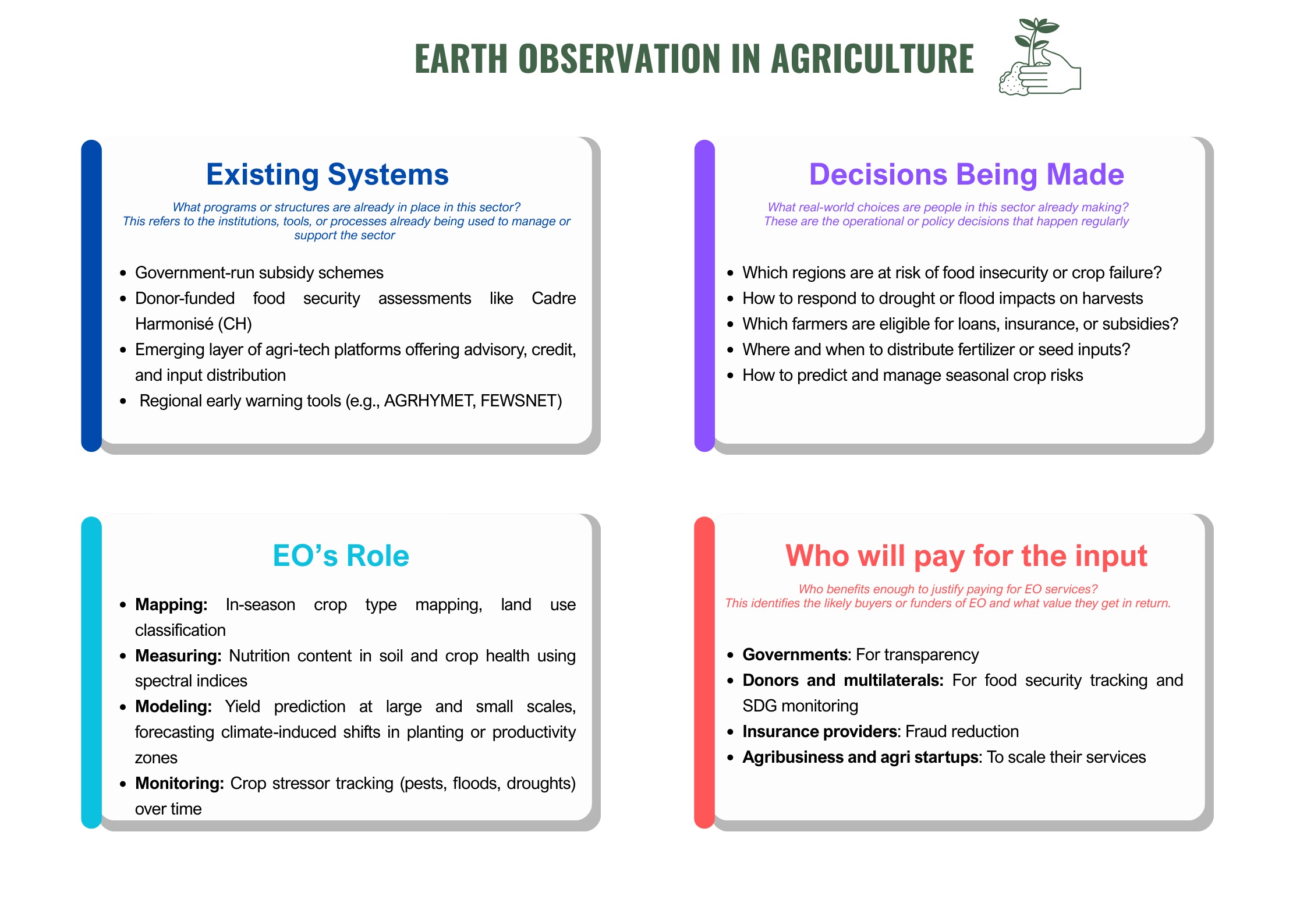

Agriculture

Agriculture has always been at the core of African economies. Over 60% of the continent's population is engaged in farming, according to the African Development Bank Group. It remains the most mature and immediate opportunity for Earth Observation (EO) in Africa being inherently spatial, seasonal, and highly sensitive to environmental variables like rainfall, soil health, and crop disease. EO’s role in agriculture spans multiple levels of complexity, from simple mapping of farmland to real-time monitoring of crop risk, and even detecting abandoned or shifting cultivation patterns in conflict zones. The continent already has operational systems in place, including government subsidy programs, food security assessments like Cadre Harmonisé, and a growing number of digital agri-platforms. These programs require regular decisions on where to distribute inputs, how to respond to climate stress, and who qualifies for credit or aid. Global EO programs like NASA Harvest are also demonstrating how satellite data can transform agricultural monitoring across Africa.

The World Bank warns that climate change could reduce staple crop yields in Sub-Saharan Africa by up to 20% by 2050. As climate change disrupts planting cycles and food security becomes a geopolitical concern, the future of global agriculture will increasingly rely on EO.

Photo from Author

Commercial Example

- Location: Germany.

- What they do: Use EO-based models to deliver crop monitoring, soil moisture, and drought insights for insurers and input providers.

- Business model: Sell EO-powered analytics to agricultural insurers, cooperatives, and climate risk platforms.

- Why it matters: Offers field-scale insights using open data for parametric insurance and advisory.

- Used in Africa: Partnered in East African for weather-index insurance and resilience programs.

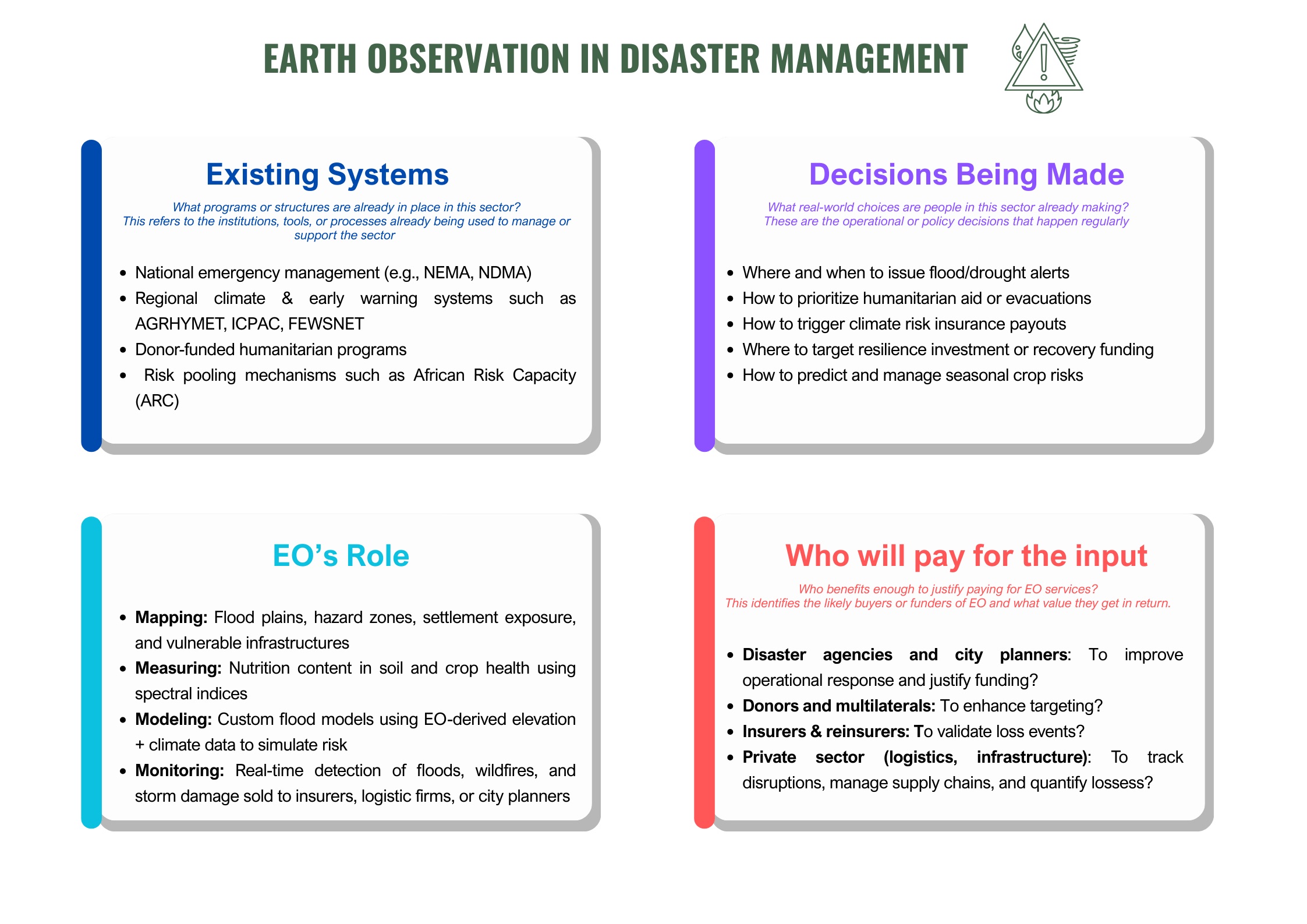

Disaster

Disaster response is one of the most urgent and commercially under-explored opportunities for Earth Observation (EO) in Africa. As floods, droughts, and displacement events grow more frequent and intense, EO offers the ability to track, forecast, and respond to these shocks in ways traditional systems cannot match. While EO is already used in global humanitarian response, its integration into commercial services like climate insurance, logistics disruption alerts, and parametric risk financing remains early-stage on the continent.

Models that combine freely available EO data with alerting tools can be sold as: SaaS platforms, APIs to insurers/logistics, and outcome-based contracts with donors. The most viable EO business models will be those that are lightweight, embedded, and sensitive to the on-ground realities that African communities face every day.

Photo from Author

Commercial Example

- Location: US

- What they do: Offer flood detection and risk modeling using public EO data (Sentinel, Landsat) + AI.

- Business model: Provide flood analytics to governments, insurers, and humanitarian agencies.

- Why it matters: Uses free EO data to power parametric insurance, early warning, and planning.

- Used in Africa: Yes, partnered with African Risk Capacity (ARC) and the World Food Programme (WFP) in Sudan and DR Congo.

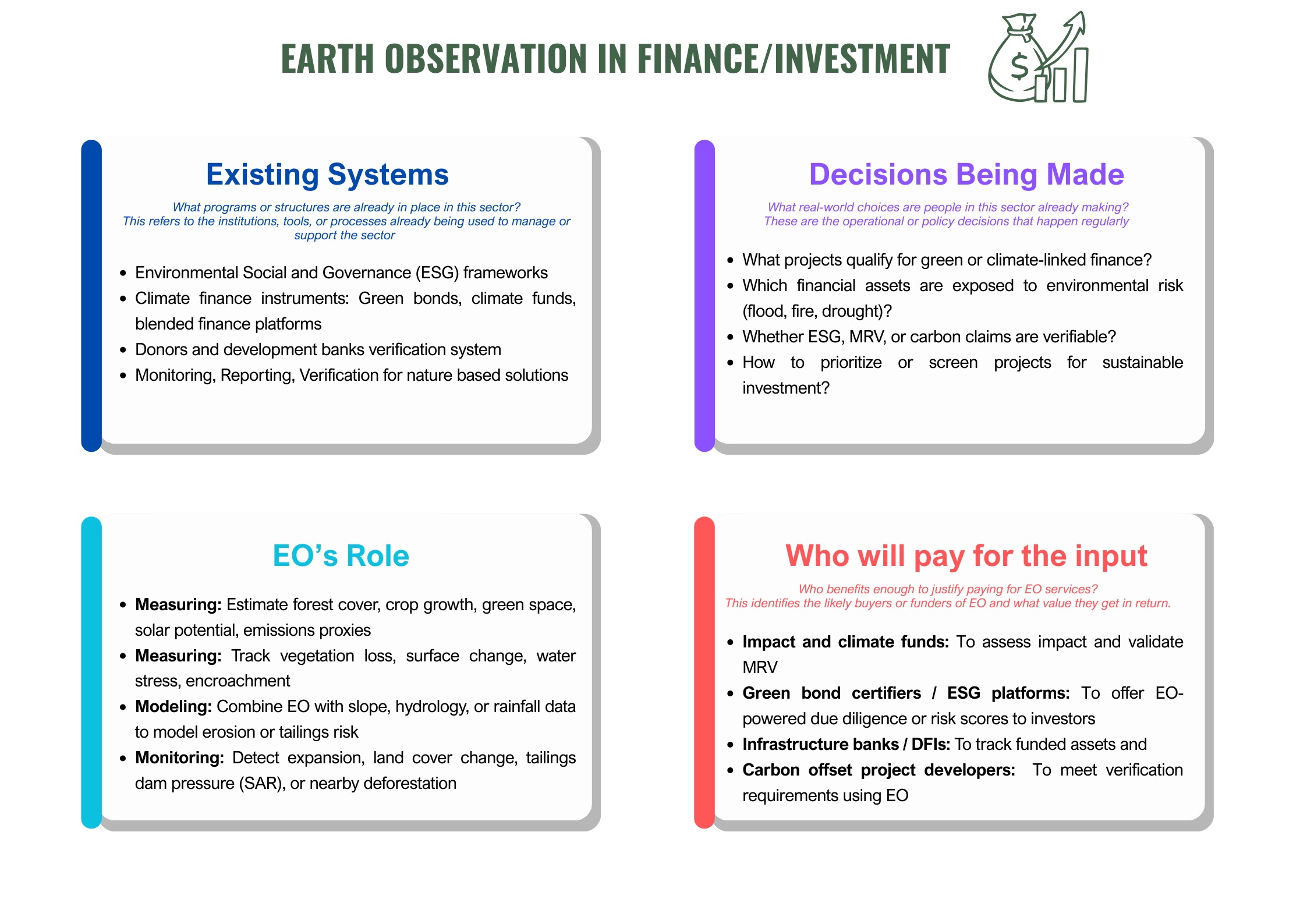

Finance/Investment

Investors, insurers, and regulators are under growing pressure to understand where assets are exposed, how landscapes are changing, and whether climate and ESG claims are verifiable. EO makes it possible to measure these things at scale, over time, and with global consistency especially in markets where field audits are limited or too costly. The impact cuts across different sectors like real estate, agriculture and carbon market where it underpins Monitoring, Reporting and Validation (MVR) for climate finance, forestry and conservation to verify land use, and infrastructure to help banks monitor project exposure. These use cases are already in motion, and in many cases, commercially driven.

In Africa, EO-backed risk analytics are increasingly relevant for green bonds, blended finance programs, and sustainable infrastructure deals.

Photo from Author

Commercial Examples

- Location: US

- What they do: Provide urban resilience and climate exposure analytics using geospatial + EO data.

- Business model: Sell access to **planning and risk dashboards for local governments, utilities, and infrastructure investors.

- Why it matters: Helps cities and asset managers plan around heat, flooding, and climate-linked inequity.

- Used in Africa: No public deployments but model is replicable.

- Location: Denmark

- What they do: Enable carbon farming by tracking regenerative agriculture practices, partly using EO.

- Business model: Monetize carbon credits generated from validated practices; sell MRV and registry services.

- Why it matters: Supports climate-smart farming and connects smallholder practices to carbon markets.

- Used in Africa: Emerging but model is relevant for Africa’s voluntary carbon markets.

- Location: UK.

- What they do: Deliver risk intelligencefor insurers, banks, and energy investors using EO and advanced analytics.

- Business model: Sell custom decision-support platforms, risk assessments, and alerts.

- Why it matters: Enables asset-level risk visibility for climate-exposed infrastructure portfolios.

- Used in Africa: Limited so far but model fits growing African infra finance.

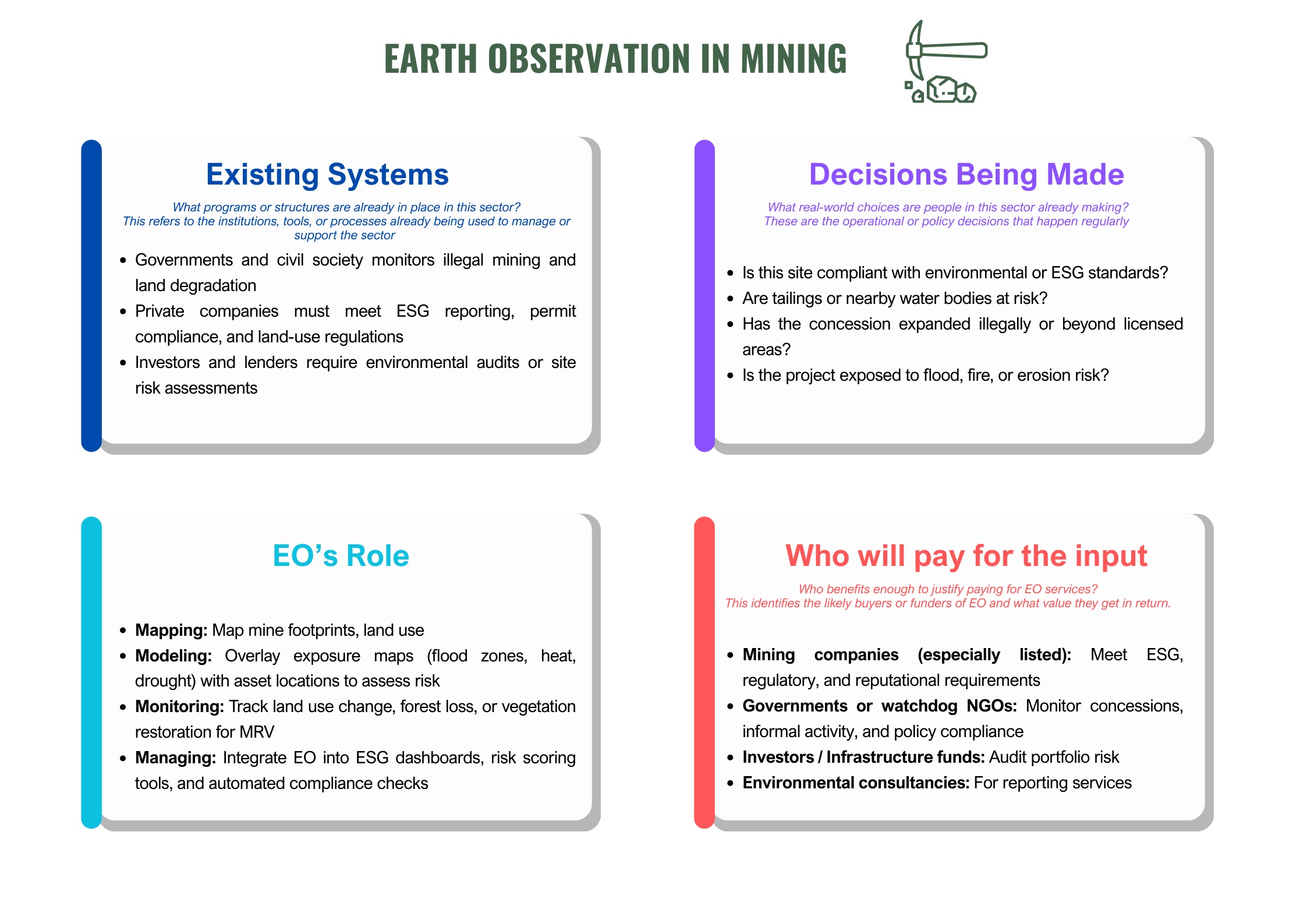

Mining

EO-backed analytics are already playing a role in asset-heavy industries like mining and extractives, where companies face pressure to demonstrate environmental compliance, avoid land conflicts, and meet international ESG standards. In the African context, where informal mining is widespread and ground monitoring is expensive, EO offers a cost-effective way to scale environmental oversight and build investor trust.

Photo from Author

Commercial Example

- Location: Brazil.

- What they do: Use open EO data and machine learning to map land use changes across forests, agriculture, pasture, and mining zones, with high spatial and temporal detail.

- Business model: Not-for-profit, but widely used as a data backbone by consultants, regulators, and ESG auditors in Latin America.

- Why it matters: Demonstrates how open EO + Deep Learning can support mining compliance, land conflict monitoring, and carbon accounting at scale and low cost.

- Used in Africa: No, but methodology and code are open-source and adaptable to African mining contexts (e.g. Ghana, DRC, Zambia).

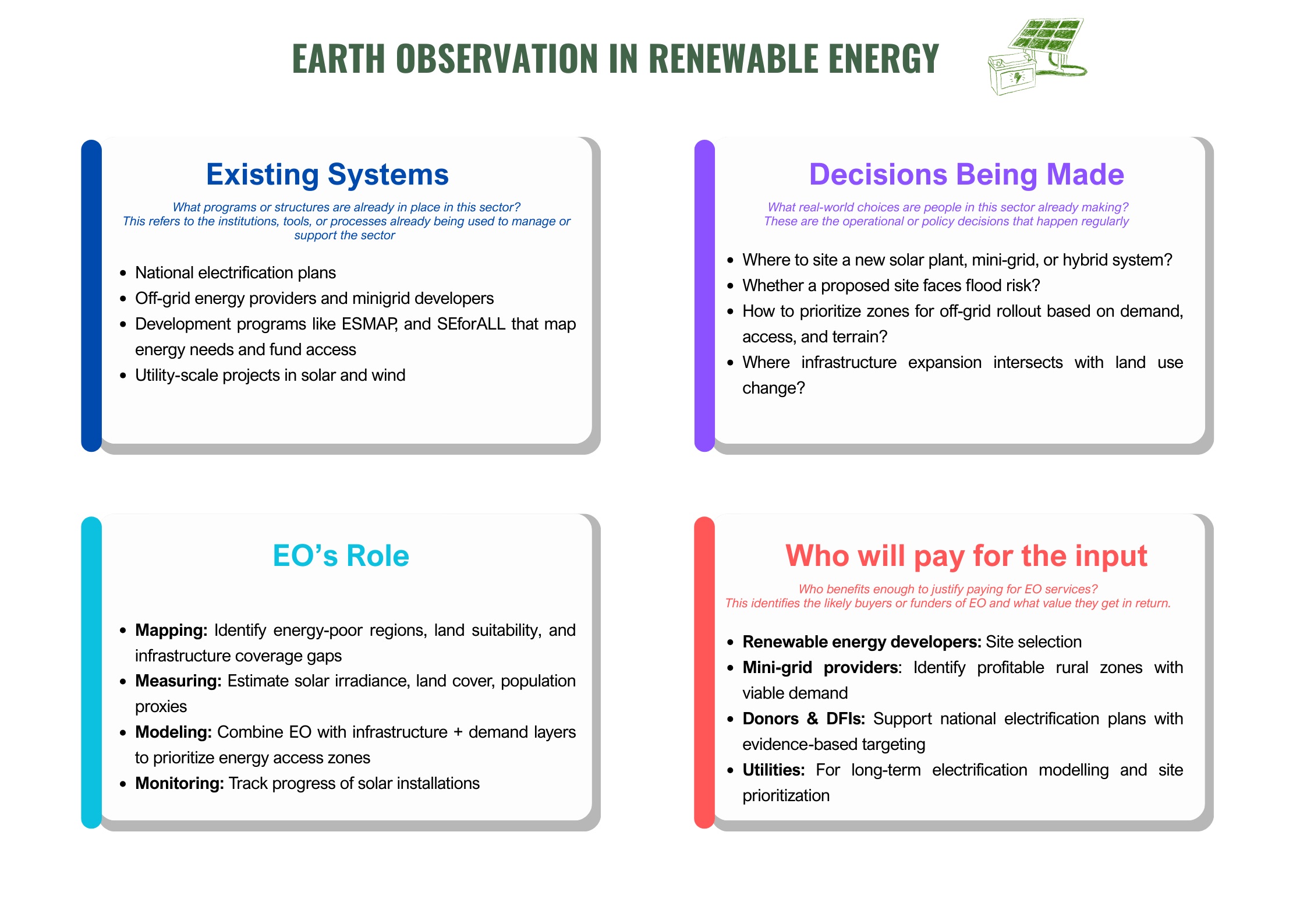

Renewable Energy

Electricity remains one of Africa’s most persistent infrastructure gaps where power cuts are routine and grid expansion is slow. Across the continent, governments, developers, and off-grid providers are racing to fill this gap with solar, wind, and hybrid energy systems, often under tight budgets and limited visibility. Yet even as this transformation gains pace, energy developers, governments, and financiers face familiar bottlenecks and this is where Earth Observation (EO) can support.

Photo from Author

Commercial Example

- Location: Slovakia.

- What they do: Provide high-resolution solar resource data, performance monitoring, and analytics to support solar energy project development and operation.

- Business model: Offer subscription-based services, reports, and APIs to solar developers, asset managers, and energy consultants.

- Why it matters: Solargis uses a mix of EO-derived solar irradiance data and atmospheric models to deliver bankable assessments that reduce risk for investors and developers.

- Used in Africa: Yes, widely used in solar feasibility studies across Sub-Saharan Africa by developers, DFIs, and climate finance platforms.

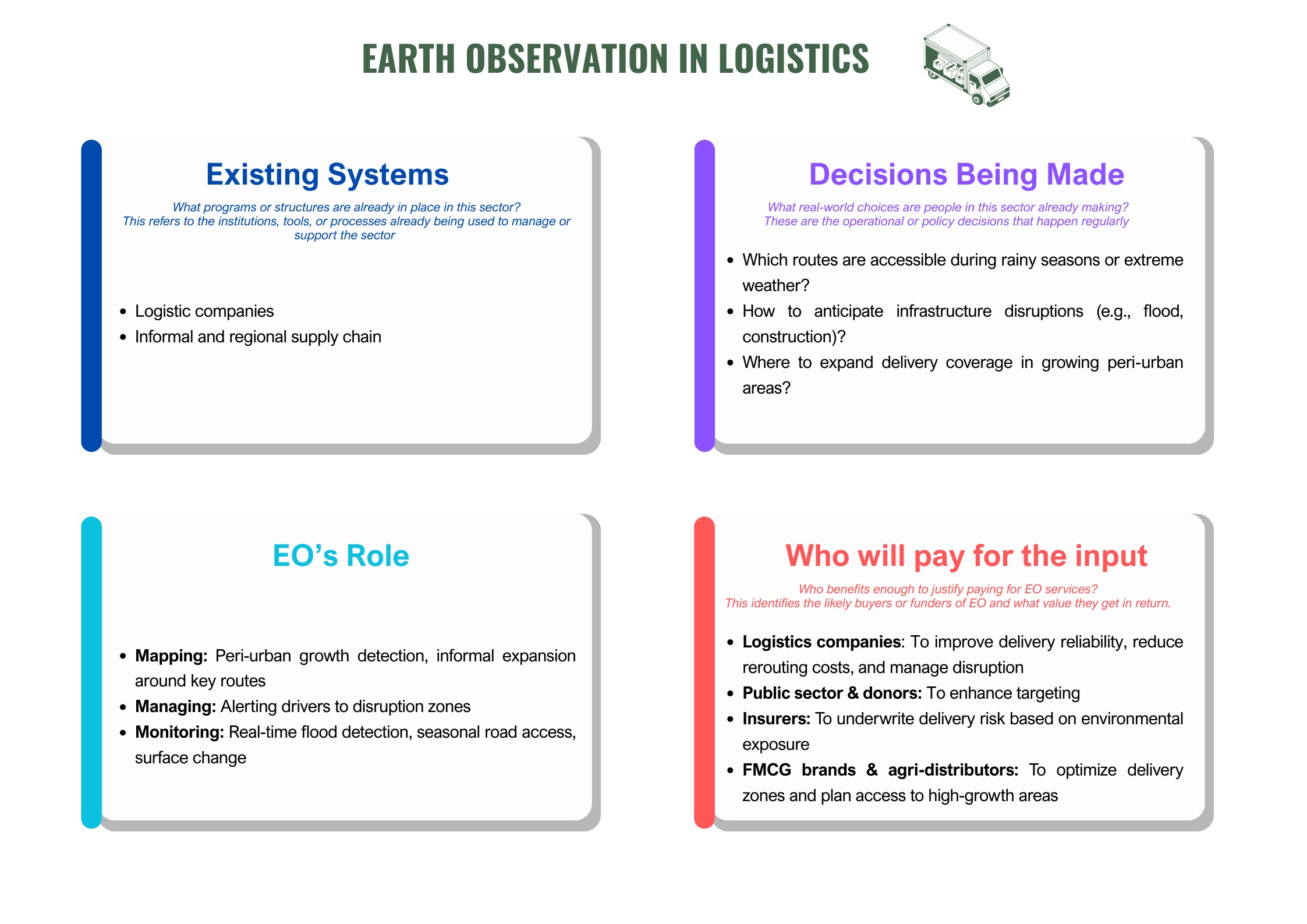

Logistic and Transport

In logistics, time is money and disruption is risk. Logistics and EO seem like a natural fit, especially for infrastructure planning and flood risk awareness but the commercial model is still unclear. Globally, EO is embedded into risk platforms, infrastructure tools, or planning models that logistics firms depend on. This enables companies to anticipate and mitigate the impact of adverse events such on supply chain operations and infrastructure exposure along key logistics corridors.

Here, EO presents a valuable complement as a layer of infrastructure intelligence that can be embedded into broader logistics platforms. Rather than being standalone, EO can be absorbed by the systems that keep these companies moving.

Photo from Author

Conclusion

Earth Observation is clearly valuable and in many sectors, the technical case is already proven. But a commercially viable EO market doesn’t grow on technology alone. There need to be incentives to adopt, standards to follow, and systems that reward accountability. And that’s where policy still has a critical role to play. Without policy signals, many of these EO use cases will remain stuck and unable to scale.

At the same time, it’s important to remember that many EO use cases are already possible today using free, open satellite data. Sectors like agriculture, disaster response, and finance already have clear entry points. The next step is to build tools and services that adapt to technical constraints, simplify delivery, and speak directly to the needs of users on the ground. But building a viable EO market in Africa also means understanding our own markets. The market structure, purchasing power, and demand patterns across the continent are fundamentally different. Companies are already solving real problems often without knowing that EO could make those solutions faster, cheaper, or smarter. The opportunity isn’t just to introduce new technology, but to prove that EO can reduce operating costs and improve outcomes in ways that make commercial sense.

Final Thoughts

If you’ve made it through this series, chances are you care about building a strong market for Earth Observation in Africa. The core challenge is clear, we need an ecosystem that can turn EO’s capabilities into real, lasting impact. A functional EO ecosystem can deliver:

- Clear career pathways for graduates beyond training programs.

- Viable markets for entrepreneurs and innovators.

- Investable ventures for funders seeking long-term value.

Yes, the politics can be complex. But our focus must be on building systems not just delivering support. In the end, this creates a shared value and opportunity for everyone.

References

- Satellite Data as an Important Catalyst for Business Trends

- THE EARTH OBSERVATION HANDBOOK Special Edition for the 3rd UN World Conference on Disaster Risk Reduction

- How Earth observation is cultivating the future of agriculture

Addendum

Additional information after the initial publication.

- The Cadre Harmonisé is West Africa’s official framework for classifying food and nutrition insecurity, informing everything from government food aid targeting to donor financing and emergency response planning.